By Carolina Mandl

NEW YORK (Reuters) – Hedge fund giant Bridgewater Associates added shares of Tesla to its portfolio in the fourth quarter, while it trimmed exposure to the rest of the “Magnificent Seven” group of U.S. tech and growth stocks, a regulatory filing showed.

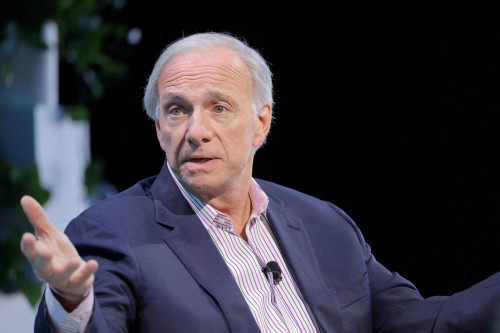

The firm founded by investor Ray Dalio ended December with a small stake in Elon Musk’s electric carmaker, comprised of 153,589 shares and worth $62 million, according to the filing late on Thursday.

Shares of Tesla are down roughly 13% this year and down more than 26% since their all-time closing high on December 17. However, the stock remains up well over 30% since the November 5 presidential election, with the company seen as benefiting from Musk’s close association with President Donald Trump.

The billionaire entrepreneur is heading the Department of Government Efficiency, which is in charge of cutting waste from federal agencies.

Meanwhile, the macro hedge fund made sizeable cuts in the rest of its Magnificent Seven stocks. It slashed its stake in Apple by 40% to 617,203 shares, and reduced its position in Amazon by almost 35%.

Cuts in Nvidia, Microsoft, Meta and Alphabet ranged between 17.3% and 26.4%. However, those positions were still worth hundreds of millions of dollars.

In a recent letter to investors, Bridgewater’s co-chief investment officer, Karen Karniol-Tambour, discussed the concentration of investors in AI stocks, saying it “creates significant portfolio diversification challenges.”

The fund positions were revealed in quarterly securities filings known as 13Fs. While backward-looking, these snapshots show what funds owned on the last day of the quarter and are one of the few methods by which hedge funds and other institutional investors declare their positions. The filings do not indicate exact timing of purchases or sales and may not reflect current holdings.

The hedge fund did not immediately comment on the changes in its portfolio.

(Reporting by Carolina Mandl in New York; Editing by Lewis Krauskopf and Matthew Lewis)